We have a deep knowledge of high net worth families and their financial needs. We specialize in what we know best. With our combined years of financial expertise, we are uniquely qualified to provide tailored family wealth management for the needs of our clients.

We have a proven investment approach. As your family and your financial life evolve, our comprehensive approach helps you manage the complexities of your wealth, synchronizing and simplifying your overall financial picture.

We always put our clients first and deliver unparalleled client service. Our business is based on successful relationships and providing exceptional client service. We work hard to earn your trust and even harder to keep it. We have years of experience helping successful people manage their finances and build wealth. Our concentrated focus gives us comprehensive understanding of the unique investment, tax and risk management strategies high-net worth individuals need to build a successful wealth plan. We know your life is busy. So we remove unnecessary complexity and provide simple, straightforward financial advice and solutions so you can stay focused on the things you want to do every day.

What To Expect

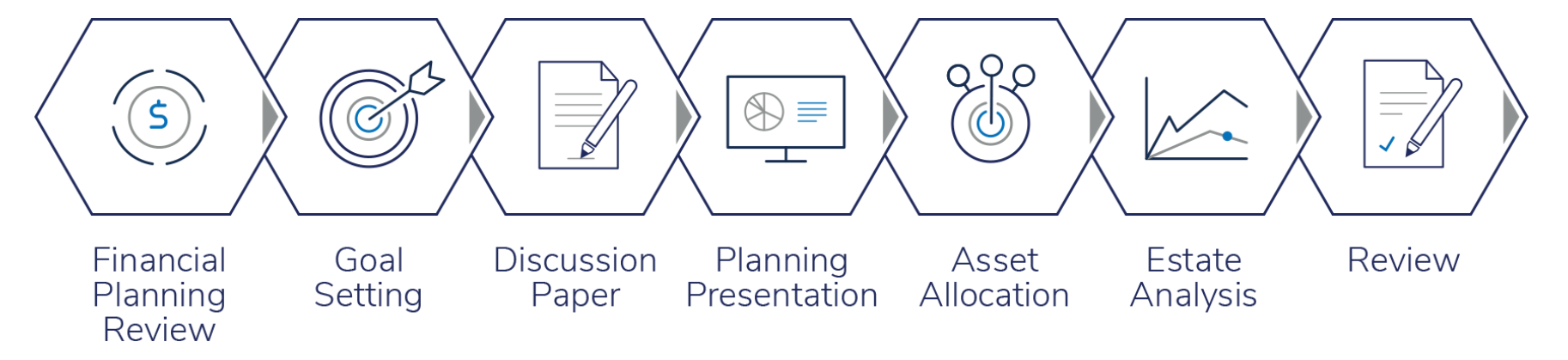

Guided by our 7-step True Wealth Management process, our personalized advice goes beyond just financial planning; it’s a roadmap that evolves with you at every stage of your life and career

Step 01

Family Financial Planning Review and Discovery

We start by compiling your information and conducting an in-depth review of your family’s financial situation. This includes all aspects of your financial life such as your personal and corporate tax planning and tax minimization, investment management and structuring, cash flow management, risk management strategies, work/life balance, philanthropic goals, estate/trust planning and long-term family legacy management. We will also outline our financial planning strategies, explain the services we provide and establish our roles and responsibilities.

Step 02

Goal-setting and Family Values/Mission Statement

In all our years in the financial planning business, rarely do clients tell us their goals are to simply “have more money”. Together we help define and prioritize your goals and family aspirations. By helping our clients articulate the “true purpose” of their wealth and legacy, we can outline and ensure the roadmap for their long-term success and legacy. Our clients’ biggest scarcity is not money, it is time. Ultimately, our goal for each of our client relationships is to deliver the peace of mind that our clients deserve so they can live and fulfil their lifelong passions.

Step 03

Family Wealth Management Plan and Advanced Tax Planning

We conduct an in-depth and comprehensive analysis of your current financial situation. We develop strategies to address your financial needs and priorities. Unfortunately, too many financial firms pay lip service to truly integrated tax planning. We focus on advanced tax management and structuring. Our concentrated focus on integrated tax planning and tax minimization better position our clients future irrespective of stock market direction. In addition to advanced tax planning, investment management and portfolio risk reduction, cash flow and debt management, how to best get money out of their corporations tax efficiently, education planning, family trusts, retirement planning, succession planning how best to sell/exit your practice, philanthropic goals, prudent use of leverage, estate planning and family legacies are all common areas of our focus in our clients’ Family Wealth Management Plan.

Step 04

Family Wealth Management Plan Presentation and Implementation

Over the years, we have seen many fancy, expensive and sophisticated financial plans collect dust on someone’s shelf. A financial plan (or any plan for that matter) is not worth the paper it is written on unless it is successfully implemented. From concept to design to implementation, we quarterback and execute our client's financial strategies with an aim to ensure their long-term successful outcomes.

Our clients’ biggest scarcity is time. By shifting the responsibility of implementation from our clients to us, we become accountable for our clients meeting and exceeding their goals. What gets measured, gets done. We present and explain all of our recommendations, address any questions you or any of your other advisors (accountants, lawyers, etc,) may have and begin the process of implementation of your plan.

Step 05

Asset Allocation and Risk management

Each client and their situation are unique. Their hopes, dreams, fears and family dynamics. That’s why we analyze and assess each clients’ comfort with risk/volatility with an objective to ensure their wealth grows in a prudent, moderate fashion while minimizing much of the downside risk. We actively monitor and manage all client portfolios so that our clients can sleep well at night.

Step 06

Estate and Succession Planning

No family wealth management plan is complete without a fully integrated estate strategy. Tax minimization, protecting family legacy for children from potential marriage breakdown and other outside risks, reducing probate fees, family trusts and philanthropic legacy are paramount in designing family estate structures.

Step 07

Ongoing Review and Monitoring

A family wealth management plan is a living document. Life doesn’t stand still, nor does your family, nor should your family wealth management plan. We regularly revisit your progress with the goal to ensure that you are meeting or exceeding your short, medium and long term goals. Tax laws change, economies and markets shift. We strive to take the worry and hassle away for our clients as we continually keep abreast of changes and opportunities to make timely adjustments. You have to be nimble in this economic environment.